us exit tax rate

Youre going to get taxed by the IRS on that US1 million gain. The US imposes an Exit Tax when you renounce your citizenship if you meet certain.

Brexit Definition British Exit From The European Union

The United States has a unified gift and estate tax system that applies to gifts made during life and bequests made at death.

. Exit tax is a tax paid by covered expatriates on the assets that they own. As the percentage of this amount that you must pay as part of your exit tax is based on your marginal tax rates it is likely to be different for everyone currently it cannot be. For 2019 the net gain that you otherwise must include in your income is reduced but not below zero by 725000.

This is per person so theoretically both you and your spouse could each be worth 19 million and still avoid the exit tax. In the United States the expatriation tax provisions under Section 877 and Section. It is paid to the IRS as a part of annual tax returns.

Generally if you have a net worth in excess of 2 million the exit tax will apply to you. The Basics of Expatriation Tax Planning. It kicks in when individual net worth tops 2 million or when average annual income tax exceeds 165000 for five years.

Once you have paid the exit tax either in a giant lump sum up front or because of the 30 withholding made on payments as you receive them you have cash in your pocket. If the payer of the deferred compensation is a US citizen and the taxpayer expatriating has waived the right to a lower withholding rate clarification needed then the covered expatriate is. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status.

You will also be taxed on all your deferred compensation. This tax is based on the inherent gain in dollar terms on ALL YOUR ASSETS including your home. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

Since 2008 the US. The exit tax is an income tax on 1 unrealized gain from a deemed sale of worldwide assets on the day prior to expatriation. Citizen who relinquishes his or her citizenship and 2 any long-term resident of the United States who ceases to be a lawful.

An expatriation tax is a tax on someone who renounces their citizenship. If you have US5 million in gold that you bought at an average price of US1300 per ounce and the price of gold the day you. The mark-to-market tax does not apply to the following.

It will be as. Currently net capital gains can be taxed as high as. The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain.

It is paid to the IRS as a part of annual tax returns. The term expatriate means 1 any US. The decision to become a US tax resident or to leave the US tax system is not one that should be taken lightly.

For 2021 the highest estate and gift tax rate is 40 percent. Your average net income tax liability from the past five years is over. IRS tax rules for expatriation from the United States requires a complicated tax analysis to determine if the expatriate must pay US.

The exit tax is essentially the application of US income tax on the portion of that phantom gain that exceeds US690000 as of 2015 as indexed for inflation. Anytime a US citizen or long-term permanent resident chooses to. You are a covered expatriate if you have become an expatriate with assets worth 2 million or more had an average annual net tax liability of more than 168000 over the last five years or have not filed the form 8854 for the year of expatriation.

If you are covered then you will trigger the green card exit tax when you renounce your status. The Basics of Expatriation Tax Planning. In some cases you can be taxed up to 30 of your total net worth.

Eligible deferred compensation items. Has imposed its own exit tax. Ineligible deferred compensation items.

And 2 the deemed distribution of IRAs 529 plans and health.

Exit Tax In The Us Everything You Need To Know If You Re Moving

Exit Tax Us After Renouncing Citizenship Americans Overseas

Renounce U S Here S How Irs Computes Exit Tax

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

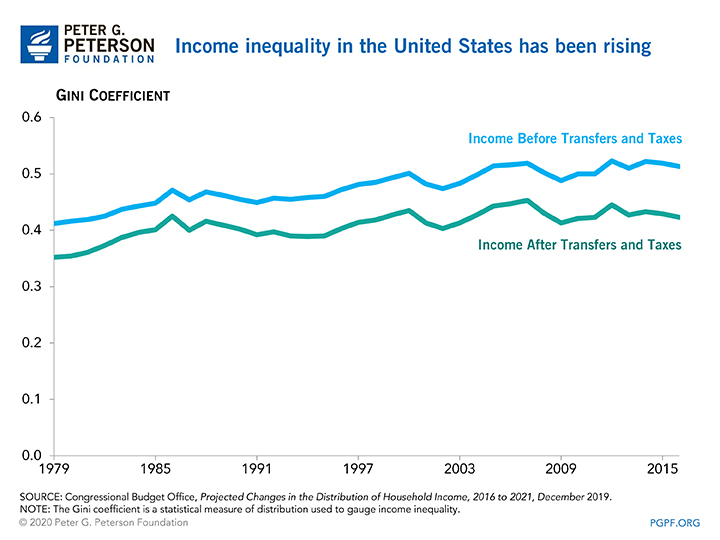

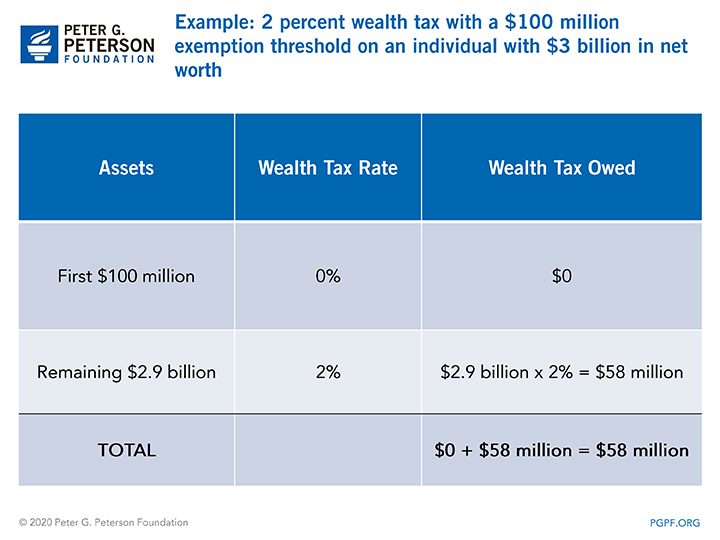

What Is A Wealth Tax And Should The United States Have One

What Is A Wealth Tax And Should The United States Have One

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

The Taxes That Raise Your International Airfare Valuepenguin

What Is Expatriation Definition Tax Implications Of Expatriation

Exit Tax Us After Renouncing Citizenship Americans Overseas

What Is Expatriation Definition Tax Implications Of Expatriation

When Might Renouncing Us Citizenship Make Sense From A Tax Point Of View

Exit Tax Us After Renouncing Citizenship Americans Overseas

Exit Tax Us After Renouncing Citizenship Americans Overseas

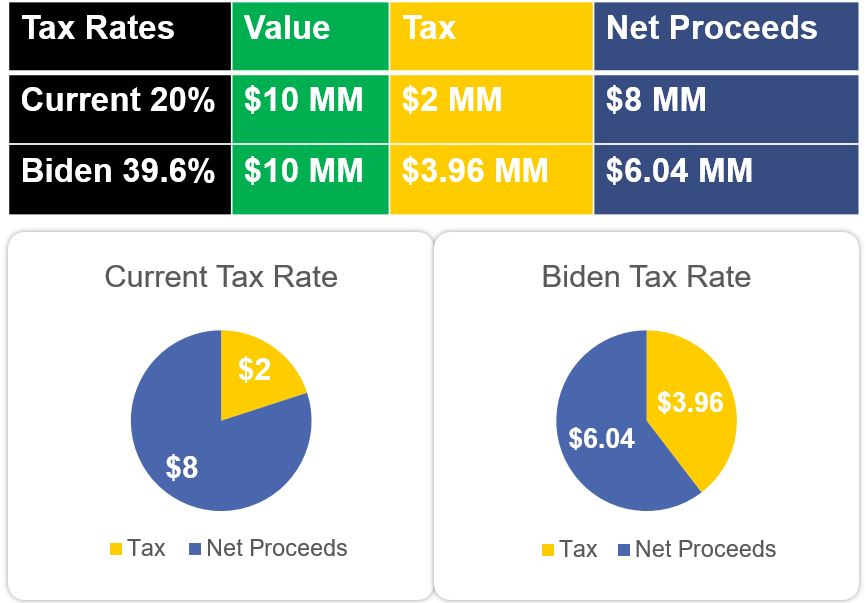

The Proposed Biden Tax Plan Will Double Taxes When Selling Your Business Affinity Ventures

Beware Exit Tax Usa Giving Up Your Green Card Or Us Citizenship Can Be Costly