student loan debt relief tax credit virginia

If you are a former Virginia College student you may not even have to pay back your student loan here are some options you have. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

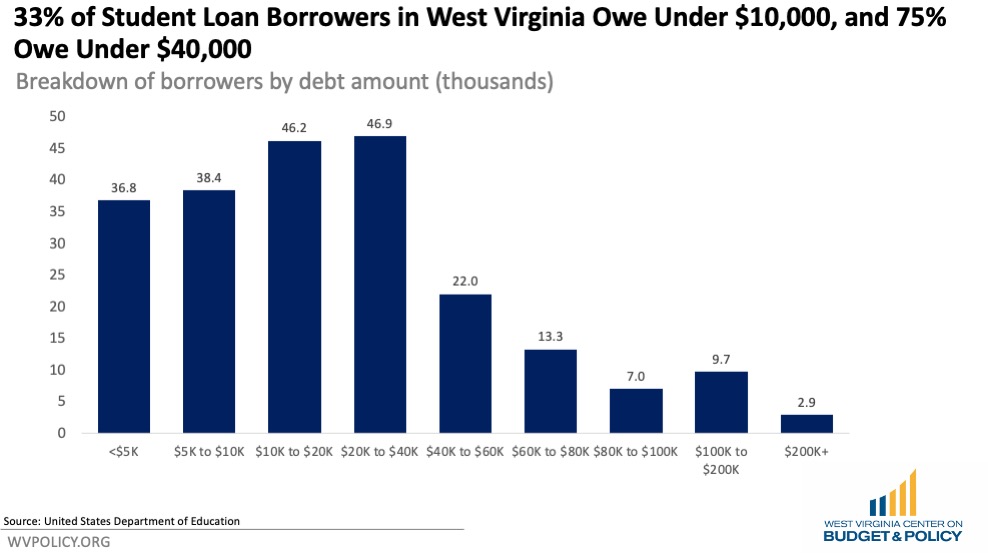

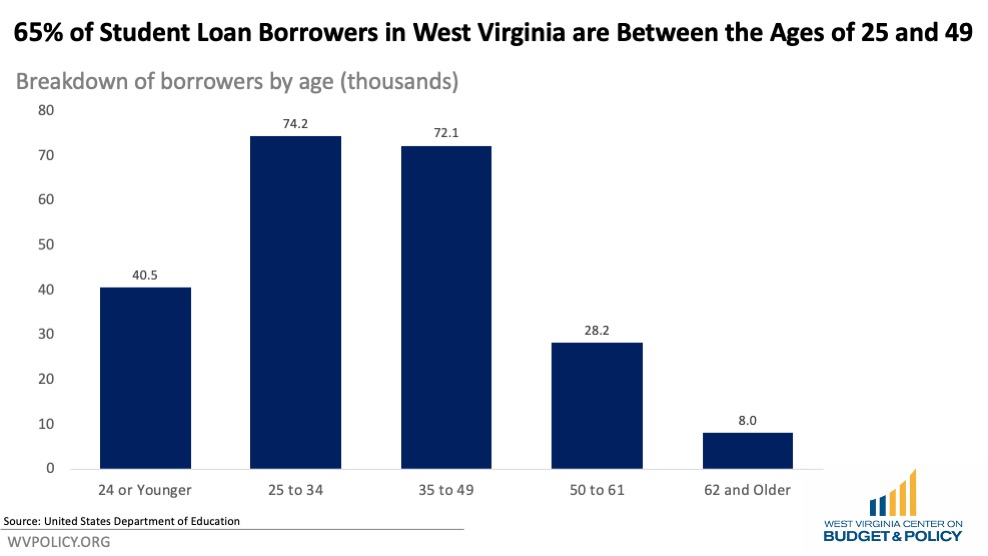

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

To qualify you must be making payments on student loan debt incurred in pursuit of eligible undergraduate or graduate degrees from accredited universities or colleges.

. If you teach full-time for five complete and consecutive academic years in certain elementary or secondary schools or educational service agencies that serve low-income families and meet other qualifications you may be eligible for forgiveness of up to a combined total of 17500 on eligible federal student loans. Repays up to 300000 of student loan debt in tax-free funds over a period of up to 10 years for eligible dentists doctors and mental health care professionals. This program offers tax relief for.

This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit. Michigan State Loan Repayment Program. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability.

COVID-19 Real Estate and Personal Property Tax Relief Program. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for Maryland resident taxpayers who are. The Full List Of Student Loan Forgiveness Programs By State.

Save even more by having your 2021 taxes prepared for FREE at one of our many VITA locations throughout the county. From July 1 2021 through September 15 2021. Your free account with Savi is here to help.

Review the credits below to see what you may be able to deduct from the tax you owe. Garten Loan Repayment Assistance Program 1 LRAP is intended to help programs recruit and retain qualified attorney staff. Financial relief is coming to more than 200000 Virginians with privately-held student loans.

Student loan debt relief tax credit virginia. Virginia provides a subtraction from income for student loan discharges due to the students death. To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page.

ANNAPOLIS MD Governor Larry Hogan today announced nearly 9 million in tax credits to more than 9000 Maryland residents with student loan debt awarded by the Maryland Higher Education Commission MHEC. Maryland Student Loan Debt Relief Tax Credit Program More Than 9K Marylanders Will Receive Student Loan Tax Credit. Below is a list of resources offering housing financial and pandemic assistance.

LSC Loan Repayment Assistance Program. WRIC Virginia Attorney General Jason Miyares along with attorneys general from 9 other states has finalized an agreement to forgive the debt of students who attended a. Failure to do so will result in recapture of the tax credit back to the State.

Virginia Loan Forgiveness Program for Law School. Student Loan Debt Relief. Up to 5600 yearly for 3 years.

Take advantage of this money-saving opportunity to find student loan debt relief by enrolling for free today. For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in compromise partial payment strategies innocent spouse company tax liens garnishment release trust fund fine and presently non-collectible. About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida.

The LSC Herbert S. About the Company Student Loan Debt Relief Tax Credit 2021. Participants must work full time at a nonprofit health clinic for a minimum of two years to qualify.

MHEC Student Loan Debt Relief Tax Credit Program for 2021. For tax obligation financial obligation relief CuraDebt has an exceptionally professional team addressing tax financial debt problems such as audit protection facility resolutions offers in compromise deposit plans innocent partner business tax liens garnishment launch count on fund penalty and also currently non-collectible. Provide partial debt cancellation for each borrower with household gross income between 100001 and.

Dont delay this program is set to end in December 2022. CuraDebt is a debt relief company from Hollywood Florida. Cancel up to 50000 in student loan debt for borrowers with 100000 or less in household gross income.

Credit Card Debt. It does not apply to discharges of private student loans. This tax credit is given to help students offset some of their outstanding loan balances and has helped many of them since the program first began in 2017.

Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their college loan debt and provide proof of payment to MHEC. Friday June 3 2022. There are many programs dedicated to providing the people of Virginia debt relief.

It was established in 2000 and has since become an active member of the American Fair Credit Council the US Chamber of Commerce and has been accredited through the International Association of Professional Debt Arbitrators. To date nearly 41 million in tax credits has been awarded to Maryland residents. Open from Jun 30 2022 at 1159 pm EDT to Sep 15 2022 at 1159 pm EDT.

In addition to credits Virginia offers a number of deductions and subtractions from. Since its launch in 2017 more than 40600 residents have. On December 13 2018 the Department of Education announced it would be wiping 150 million in student loans for 15000 borrowers whose schools closed on or after Nov.

Student Loan Debt Relief Act legislation to cancel student loan debt for 42 million Americans. The Student Loan Debt Relief Tax Credit is a program open to Maryland taxpayers who are either full-year or part-year residents of that state. It was founded in 2000 and has been a participant in the American Fair Credit Council the US Chamber of Commerce and accredited by the International Association of Professional Debt Arbitrators.

Virginia excludes the total and permanent disability discharge from income on state income tax returns but only for veterans and only through 2025.

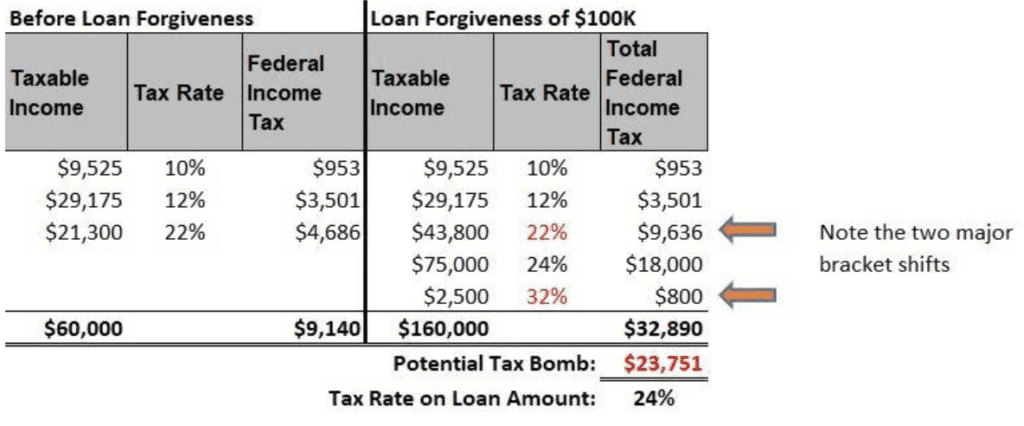

Tax Bills Are Major Student Loan Forgiveness Con Student Loan Planner

Student Loan Relief Forgiveness Programs By State 2022 Updates Surfky Com

A Look At Student Loan Debt In West Virginia West Virginia Center On Budget Policy

Virginia Student Loan Forgiveness Programs

Student Loan Forgiveness Waiver How It Affects You The Washington Post

Here S What Biden S Student Debt Forgiveness Could Look Like

Student Loan Payment Pause Extended To August 31 The Washington Post

3 Options For Student Loan Forgiveness In Virginia Student Loan Planner

Virginia College Loan Forgiveness Options Debt Strategists

Latest White House Plan Would Forgive 10 000 In Student Debt Per Borrower The Washington Post

Biden Administration Resists Democrats Pleas On Student Debt Relief As Deadline Nears Virginia Mercury

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Biden Issues Any Decree He Wants On Student Loan Forgiveness Foxx

Student Loan Forgiveness Help Relief Find Out If You Qualify

Student Loan Forgiveness White House Weighs Structure The Washington Post

Learn How The Student Loan Interest Deduction Works

Who Owes The Most Student Loan Debt

Va Disability Student Loan Forgiveness Hill Ponton P A

Student Loan Forgiveness A Regressive Policy That Hurts Working Americans The Heritage Foundation